Are you looking for Viwango vya Mkopo wa Diploma Heslb Loan Features and Rate kiwango cha mkopo kwa diploma kupata mkopo bodi ya mikopo jinsi ya kutuma how to apply jinsi ya kufungua akaunti how to create account jinsi ya kujisajili how to register Application form fee allocation status olams portal student. Welcome to our website orodhaya.com, In This Article,!

LOAN FEATURES AND RATES

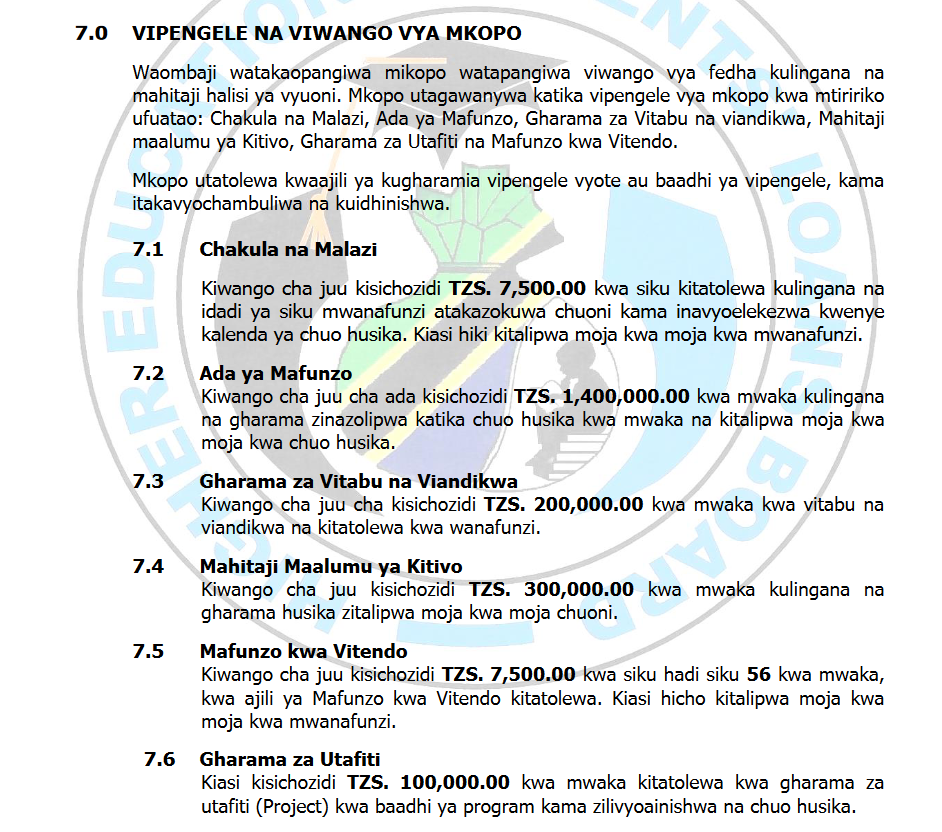

The Viwango vya Mkopo wa Diploma Heslb Applicants who will be assigned loans will be assigned financial rates according to the real needs of colleges. The loan will be divided into loan components respectively the following: Food and Accommodation, Tuition Fee, Cost of Books and Materials, Requirements Special Faculty, Research and Practical Training Expenses.

Diploma Heslb Loan Rate The loan will be given to cover all or some of the components, such as will be analyzed and approved.

- Food and Accommodation: Maximum amount not exceeding TZS. 7,500.00 per day will be given according to the number of days the student will be in college as directed on the relevant college calendar. This amount will be paid directly to the student.

- Tuition Fee: Maximum fee not exceeding TZS. 1,400,000.00 per year accordingly and expenses paid in the respective college per year and will be paid once per one for the respective college.

- Costs of Books and Materials: The maximum amount does not exceed TZS. 200,000.00 per year for books and documents and will be given to students.

- Special Faculty Requirements: Maximum amount not exceeding TZS. 300,000.00 per year according to relevant costs will be paid directly to the college.

- Practical Training: Maximum amount not exceeding TZS. 7,500.00 per day up to 56 days per year, for Practical Training will be provided. The amount will be paid once per one per student.

- Research Costs : The amount does not exceed TZS. 100,000.00 per year will be provided for the expenses of research (Project) for some programs as specified by the relevant college.

Read:

OTHER TERMS

Responsibilities of Guarantor and Parent/Guardian

Parents/Guardians and guarantors are responsible for verifying the accuracy of the information which will be presented in the loan application form before signing.

The Guarantor/Parent will be required to ensure that the borrower fills in the correct information to be used during recovery. In addition, the guarantor will be required to provide information on

borrower and housing when he is late or fails to repay his loan. For students who are under 18 years of age when applying for a loan he will have to fill out an official declaration (declaration) agreeing to continue receiving the loan when he turns 18 years old.

The loan applicant should attach a photo (passport size) of guarantor and a copy of one of the below-mentioned identification documents which has been issued by the authorities of the Government of the United Republic of Tanzania or the Revolutionary Government of Zanzibar:-

- (i) National Identity Card

- (ii) Voter’s card

- (iii) Driver’s license

- (iv) Passport

- (v) Identity card of a resident Zanzibari resident

NB: Mkopo wa Diploma heslb The list of loan applicants who will be allocated loans will be announced through the account (SIPA) used at the time of application loan or on the HESLB website: www.heslb.go.tz after loans approved

Read:

Above It is a very important information about “Viwango vya Mkopo wa Diploma Heslb Loan Features and Rate” if you find a challenge, please contact the heslb loan board in advance or visit their pages for information